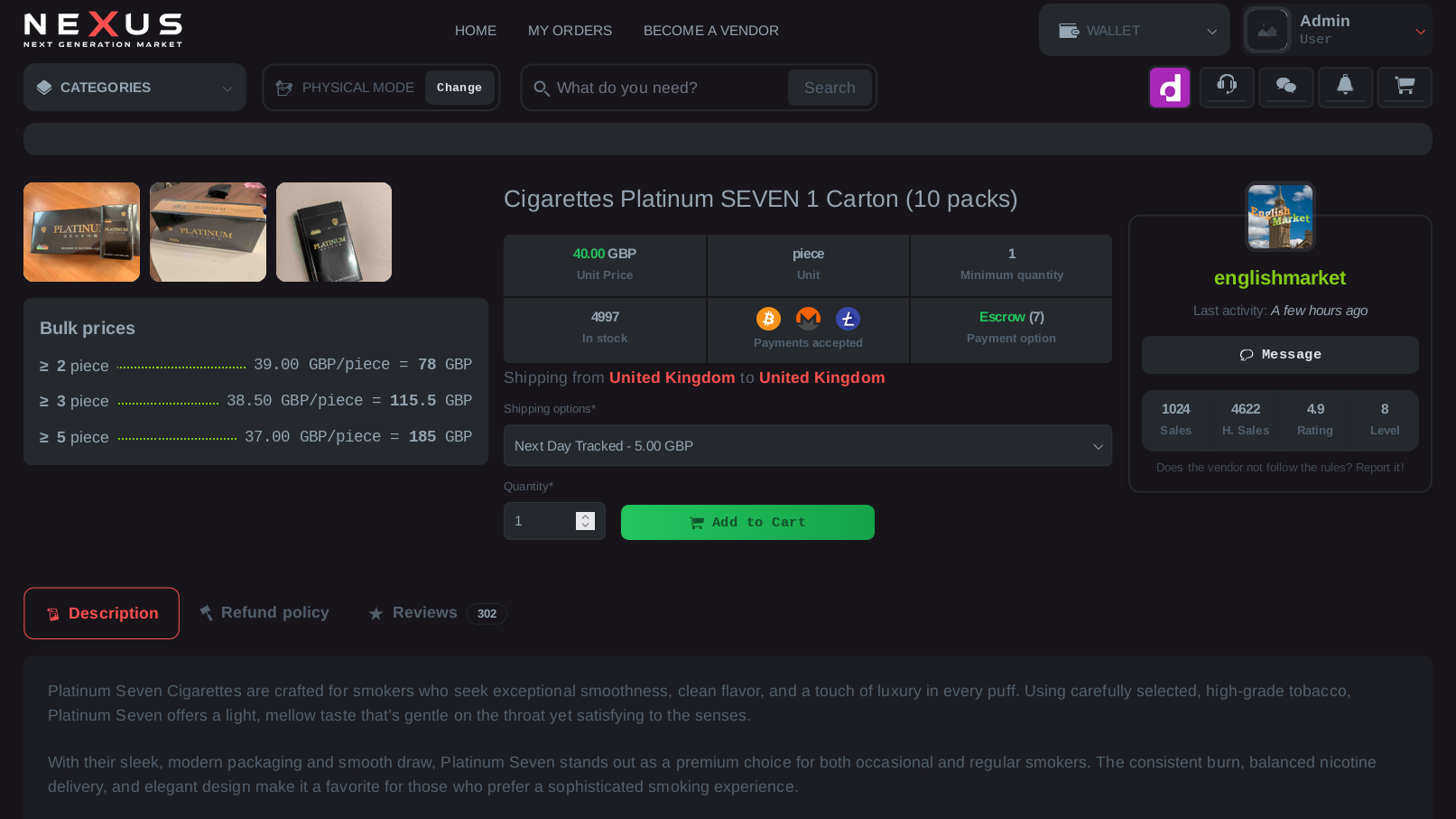

Nexus Market (est. Nov 2023) operates as a decentralized darknet trading platform built on robust security protocols and user-centric architecture. The platform was developed to address common inefficiencies in the onion ecosystem, specifically targeting fee structures and vendor accessibility. By removing the traditional vendor bond requirement while maintaining strict verification standards, Nexus has rapidly expanded its active listing database.

The platform's financial infrastructure supports a multi-currency environment, integrating Bitcoin (BTC), Monero (XMR), and Litecoin (LTC). The proprietary "walletless" payment system allows buyers to execute orders directly from external wallets, minimizing funds held in on-site hot wallets and reducing exposure to volatility or seizure vectors. Transaction security is enforced via a tiered escrow system, holding funds for 7 to 21 days depending on the physical delivery metrics, while digital goods utilize an automated instant-release mechanism.

Operational security (OpSec) remains the core tenet of the Nexus Market administration. The codebase enforces mandatory PGP Two-Factor Authentication (2FA) for all vendor accounts and encourages full end-to-end encryption for buyer communications. Withdrawal operations are processed with a minimal 1% fee structure and a low $3 threshold, ensuring liquidity and accessibility for all market participants.